In the olden days, many advisors would shutter at the word, “annuity.” And if your clients were to Google the term, they’d find all kinds of information about how bad annuities are. And don’t even get me started on all the advertisements from Fisher Investments.

However, over the past few years annuities have started to get a little shine to them. They’ve become a good option for some retirees to consider as part of their retirement portfolio. Especially in the indexed annuity space.

Annuity offerings both short- and long-term have started to provide retirees an alternative to the more traditional bond offerings. But a big problem is most retirees don’t understand the relationship between bonds and interest rates (hint: it’s inverse).

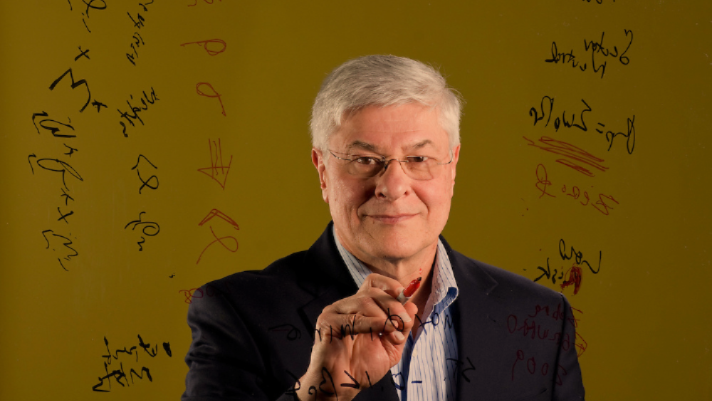

Dr. Roger Ibbotson’s FIA Whitepaper

In 2018, a whitepaper from Dr. Roger Ibbotson of Zebra Capital Management went into detail on why fixed indexed annuities (FIAs) should be considered as an alternative. Here are some of his findings:

- An FIA is a tax-deferred retirement savings vehicle that eliminates downside risk while allowing for the opportunity to participate in upside market returns

- FIAs help control market risk and mitigate longevity risk

- In his simulation, using dynamic participation rates and uncapped index crediting designs, a generic large-cap equity FIA using a large-cap equity index outperformed long-term bonds with similar risk characteristics and better downside protection over the period from 1927-2016

- An FIA may be an attractive alternative to traditional fixed income options like bonds to accumulate assets (tax-deferred) prior to retirement

Dr. Roger Ibbotson

“The problem is, too often, we simply accept conventional wisdom, which prevents us from considering other alternatives. Although it is prudent to de-risk portfolios approaching retirement, are bonds our best option?” – Dr. Roger Ibbotson

Annuities for Retirees

When talking with advisors who normally used bonds as a place for their clients’ “safe money”, or as a fixed income solution to get more yield from their bond portfolios, I often hear they’re either:

- Buying longer duration bonds which are rarely held to maturity (therefore exposing their clients to interest rate risk)

- Or, they’re using lower grade bonds

This train of thought makes me wonder how it makes sense to own an investment vehicle for a longer period from a less-qualified manufacturer?

When we look at how annuities can provide a fixed income solution for retirees, I’m unable to find better products or options with stronger guarantees. Who remembers the Four Percent Rule or the Rule of 72? If we look at what these rules really mean compared to what an annuity can provide for income, there’s really no comparison.

What if I told you that a return of around 1.2% in an annuity can provide the same fixed income as a plan that has to earn 7.2%? What do you think is more likely over the next 10 years after the unprecedented bull run of the past decade?

Look across the annuity landscape at the fixed income offerings. You can offer better income payouts, increase income during retirement, and stabilize income. All with little-to-no fees for your clients.

Return Research on Annuities

Allianz, one of the top providers of annuities, put out a whitepaper called, “Reclaiming the Future”. This whitepaper researched what consumers want and what financial professionals are providing. In their findings, they learned that “by a dramatic and conclusive margin of 4 to 1,” consumers said they prefer a retirement income product with a 4% return that’s guaranteed not to lose value versus a product with a higher 8% return that includes the possibility of losing value.

Meanwhile, 46% of the respondents said their financial professional has never recommended an annuity. Sounds to me like there is still a huge underserved population out there looking for answers to their financial questions and concerns.

Americans’ Retirement Fears

A couple of years ago, The Motley Fool had an article that reviewed a study done by Transamerica titled, “Americans’ 5 Biggest Fears About Retirement.” In it, the biggest concern was outliving their savings and investments. Can your clients and prospects afford to take a reduction of income in retirement due to a market decline? What if we have a repeat of 2008? Even worse, how do you tell a client they’re out of money?

Providing a fixed income stream to your clients’ portfolios that aren’t affected by interest rates or negative market fluctuations is key. Especially when it can provide retirees an income they can’t outlive. And that’s why annuities are gaining popularity.

Bottom Line

You can see why annuities are oftentimes used as a bond alternative for safe accumulation, a fixed income solution, and even for legacy or chronic care needs.

Think about how annuities work and what they do for your clients before and during retirement. Their ability to consistently outperform in most types of rate and market environments puts them in an asset class all by themselves.

Giving clients the peace of mind in a world that is covered with uncertainty and tons of broken promises will clearly set you apart in the industry.

Click here or contact your private client group today for expert assistance to determine your clients’ ideal annuity solution.

The content in this article is for informational purposes only. The opinions expressed herein do not necessary represent those of Financial Independence Group, LLC or any of its affiliates. Annuity products and their related features, benefits and guarantees are dependent upon the claims paying ability of an insurance company. Customer should consult a legal or tax professional regarding their own unique situation prior to making any purchase of an annuity.