Updated July 22, 2024 at 4:14 PM

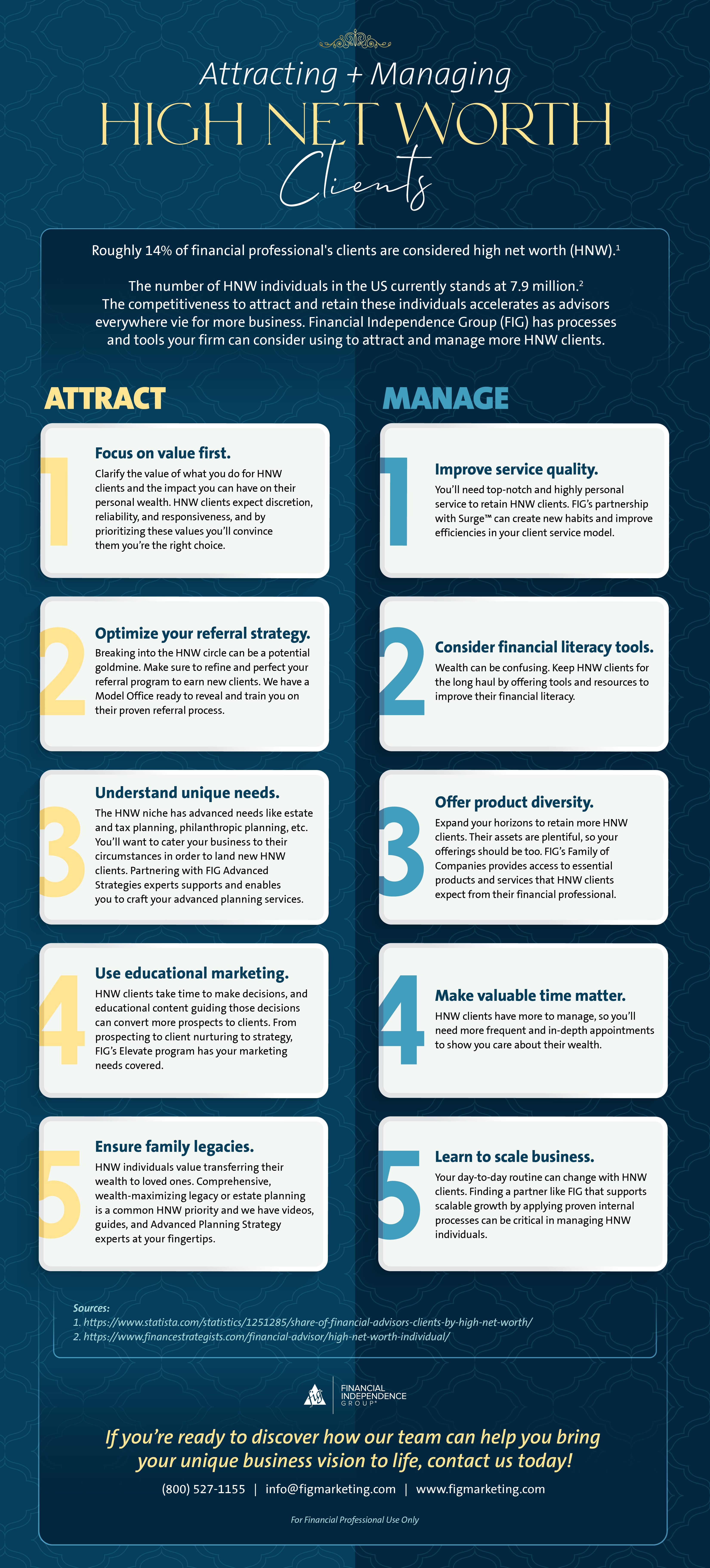

Attracting high net worth clients and managing high net worth clients are two different games in wealth management, but there are three main themes that both share: value, efficiency, and quality financial planning.

If you’re wondering how to attract high net worth clients to your business or want some tips on managing high net worth clients, we’ve highlighted ten main ways you can do so.

Read more about the tools and strategies that attract and manage high net worth individuals in the infographic at the bottom of this post. In short, here are ten high-level tips for attracting and managing high net worth clients.

How to Attract High Net Worth Clients

1. Focus on client value first.

2. Optimize your referral strategy.

3. Understand unique needs HNW individuals have.

4. Use educational marketing for attracting HNW clients.

5. Ensure HNW family legacies.

How to Manage High Net Worth Clients

1. Improve your service quality.

2. Consider financial literacy tools to educate your HNW clients.

3. Offer product diversity in your business.

4. Make a HNW client’s valuable time matter.

5. Learn to scale your business.

Want to keep this infographic handy? Download it here.

Keep Reading: How to Attract High Net Worth Clients for Wealth Management

For Financial Professional Use Only

The content within this article is for educational purposes only and does not represent legal, tax or investment advice. Customers should consult a legal or tax professional regarding their own situation. This presentation is not an offer to purchase, sell, replace, or exchange any financial product. Insurance products and any related guarantees, features and/or benefits are backed by the claims paying ability of an insurance company. Insurance policy applications are vetted through an underwriting process set forth by the issuing insurance company. Some applications may not be accepted based upon adverse underwriting results.