How do registered index-linked annuities (RILAs) compare to the newer product category, fixed index-linked annuities (FILAs)? We’re here to help break down the debate: is a RILA or FILA better for my clients?

The Expanding RILA Market

When Equitable released the Structured Capital Strategies (SCS) in 2010, the product was so innovative that the financial industry couldn’t even settle on the proper name for the category that it created.

Over time, the industry coalesced on a name for this growing product category that chalked up $1 billion in cumulative sales in 2012 the registered index-linked annuity, or RILA. Equitable was soon joined by CUNA Mutual Group and MetLife in 2013 and the RILA category nearly hit $10 billion in annual sales in 2017.

Since then, several companies have entered the space, including stalwarts like Prudential and Lincoln Financial Group. Sales have now exploded, topping $24 billion in 2020 on the back of a staggering 41% increase in sales over 2019. There’s no longer any question about it: RILAs have arrived and are here to stay.

Where RILAs Fit

What makes RILAs such a powerful and timely story is that the product chassis offers significantly more upside potential than a traditional fixed index annuity (FIA) with some level of defined downside protection, typically either in the form of a floor or a buffer.

Because RILAs are registered securities products, they can be (and often are) positioned as a true equity alternative with downside protection rather than a fixed income alternative with upside potential, along the territory of traditional FIA products.

But for clients who want the ability to protect their principal, many RILA products offer precious few options beyond the fixed account. If a RILA buyer wants to receive index-linked credits, typically their only choice is a strategy with a buffer or floor that exposes them to some level of downside risk.

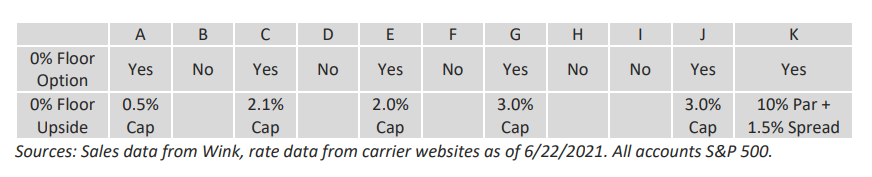

And for the companies that do offer a principal-protected strategy, the rates tend to be uncompetitive in today’s environment. Take a look at the top RILA products on the market ranked by 2020 sales:

Related: A Deep Dive into FILA Mechanics

Bringing a RILA to Market

RILAs, as a product category, are still in their nascent phase and regulations surrounding filing, structuring, and even product pricing are in the process of being solidified. What we know is that RILAs require life insurers to use a non-unitized, non-insulated separate account – something they’ve probably never had to build before.

We also know that RILAs currently require an S-1 filing for the issuing company which, again, is something that many life insurers have never had to do. For life insurers focused on traditional fixed products, RILAs also require creating infrastructure to wholesale their products through broker-dealers, something that some life insurers haven’t had to do with a variable product in a very long time.

Building a new RILA product is a massive effort compared to developing a new FIA or VA product on existing infrastructure and, in order for life insurers to justify the investment, the sales potential has to be significant.

Carving a Piece of the RILA Sales Pie

With a market that’s growing at a 41% year-over-year clip, it would seem that there’s plenty of volume to justify life insurers entering the RILA space.

But that’s only half the story. The RILA market is incredibly concentrated compared to other annuity markets. The top five RILA sellers command an 88% share of RILA sales compared to just 41% for the top five FIA sellers in the FIA market.

Many new RILA entrants have seen lackluster sales despite offering ultra-competitive rates. The exceptions to the rule are companies that have established brands and hold deep experience wholesaling into banks, wirehouses, and broker-dealers.

Success in RILA, it seems, is as much or more about distribution than the product.

The FILA Alternative

FILAs offer a compelling alternative to RILAs by retaining most of the elements of its core value proposition but within a fixed insurance chassis with competitive 0% floor rates.

Because FILAs are fixed products, they don’t require agents to have a securities license, don’t require an S-1 filing for the life insurer, don’t need a separate account, and can be distributed through traditional fixed insurance channels, including IMOs and fixed-only insurance agents.

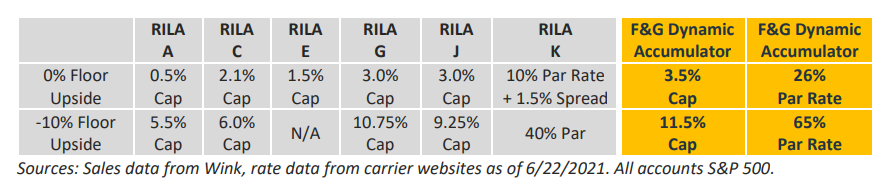

FILA distribution spans the entire annuity market, not just registered channels. In the FILA vs. RILA debate, RILA products that offer principal-protected accounts, FILA rates (from what we can tell from F&G’s

Dynamic Accumulator product) are superior to the rates offered in RILAs for otherwise identical strategies, as seen below.

The Uniqueness of FILAs

The downside for FILA, of course, is that policyholders can only access index-linked strategies with more risk and more upside potential if there are previously tracked gains to put at risk.

At no point in time can the policyholder put more than their previously tracked gains at risk, which is how FILAs guarantee principal protection. In contrast, RILAs allow the policyholder to put their principal at risk and have greater upside potential from day one – and with strategies that wouldn’t work for a FILA; such as downside buffers, downside participation rates, annual coupons, and other crediting strategies that are proving to be wildly popular in the RILA chassis.

In this FILA vs. RILA debate, FILAs offer a unique choice for consumers. Traditional FIA products are perpetually locked into 0% floors. RILA products generally don’t offer competitive 0% floor strategies, requiring the client to take downside risk in order to fully take advantage of the chassis.

FILAs, by contrast, offers both a strong 0% floor and downside risk strategies within an FIA chassis, arguably creating a product category all its own.

RILA vs. FILA: The Bottom Line

Both RILAs and FILAs allow for greater downside risk in exchange for greater upside participation.

So although the RILA vs. FILA debate can be subjective, the principal protection required in FILAs places it clearly as a fixed insurance product – and with better rates than its RILA competitors.

Editor’s Note: This article is from our partners at LifeInnovators.com, and a similar PDF version can be downloaded for free here.

Keep Reading: Fixed Index-Linked Annuity (FILA) Performance Characteristics

Copyright Life Innovators LLC 2021