Reconnecting with your clients is an opportunity to re-invent yourself. Like a New Year’s resolution, you can commit to doing things better. Pick one thing and focus on it until it becomes a habit.

To truly connect with your client, you need to observe. You need to look. And you need to listen.

Listen to what they’re saying. Look for the need, the pain, the problem—and then solve for that need. An annuity is a tool. Depending on how it’s designed, it can be a scalpel or a hammer. Or even a multitool. The more singular it is in its purpose, the more efficient it likely will be. That being said, if a client’s need is singular, solving that need is relatively simple.

However, adding just one or more other priorities to the client’s particular need can make solving that need significantly more challenging. Knowing precisely what to look for and what resources are in your toolbox can help eliminate the confusion for both you and your client.

Finding the Right Annuity for Clients

To determine where an annuity best fits, it’s easiest to begin with the need and then back into the solution. Annuities are essentially designed to address one of or a combination of four things: income, growth, legacy, and care (IGLC). Actually, it’s five if you count principal protection. But for the sake of this discussion, let’s assume the client isn’t interested in taking on any downside risk so we can rule out variable annuities (VAs) and indexed VAs.

Every insurance company is working with the same 100 pennies in a dollar. They have very similar operating costs, are working with the same investment options, and have similar profit margins. They can’t design a product that does everything as well as a product that does just one thing. If a product addresses IGLC, it won’t provide as much growth opportunity as a product designed specifically for growth.

Related: Infographic: 7 Annuity Myths (And the Truths Behind Them)

Connecting the Dots to Prioritize Annuity Benefits

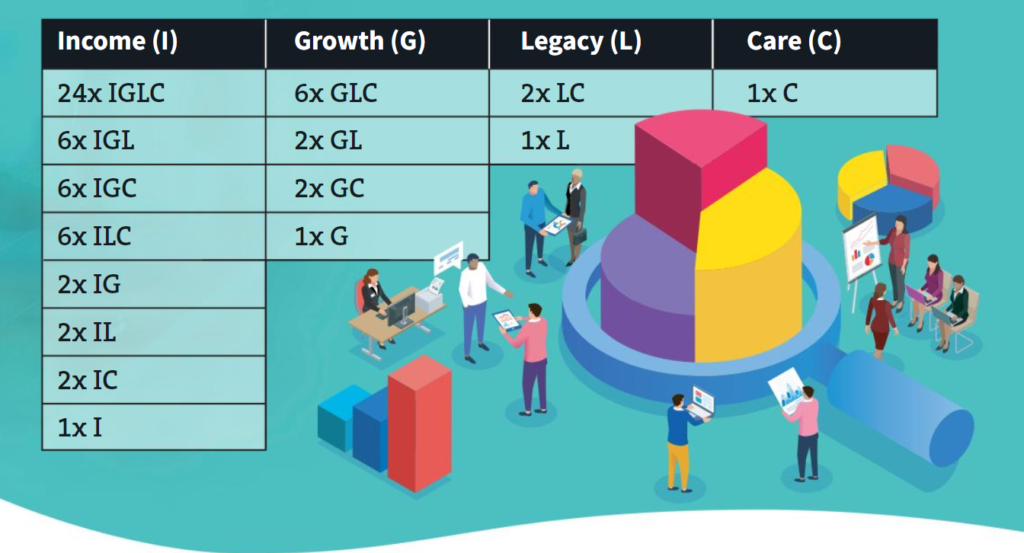

Remember, when prioritizing the client’s needs, we use the IGLC categories. As you’ll see in the table below, there are 64 combinations of potential outcomes to prioritize those benefits.

If the client desires all four features, there are 24 different ways we can prioritize the IGLC categories. The client may first want the product for income, followed by care, then growth, and lastly, legacy. Their top concern may be legacy, but if other assets underperform, they may at that point rely on the product for income and care.

Usually, they’d prefer decent performance from an accumulation value standpoint. If the client only desires three of these benefits, then there are six different ways to prioritize them, and so on—you get the picture.

Now, assume we break safe growth into two categories: guaranteed vs. indexed. We break income into two categories of level and increasing. And we add principal protection (throwing indexed VAs back in the mix), and the possible outcomes grow into the thousands! The point is, there are a lot of different ways to connect the dots.

Matching the right product to the client’s needs can be daunting considering the number of options available, especially if you’re new to using annuities in your planning. Fortunately, we don’t need to worry about the thousands of outcomes that don’t match your client’s wants and needs. We only care about connecting them with the one that does.

Connecting Clients with the Right Annuity Product

So, how do we go about doing this? There are several ways, and it boils down to what works best for you. Some have questions embedded in their fact finder that specifically address the client’s needs for IGLC. Some have a specific IGLC questionnaire that asks the client on a scale of 0-5 how important each category is, or they ask the client to rank them in order of importance. Others may create the plan and let it dictate what the client needs. Assigning a risk score can be helpful as well.

Solid client profiling using a combination of the above is often the best solution. Once you’ve determined what the need is, relay that to your vice president of annuity sales, and they’ll point you toward an option or two that perfectly addresses those needs.

Narrowing it down to IGLC can be an efficient way to cut through the clutter, the seemingly infinite universe of products available to you, and efficiently zero in on the perfect annuity solution. You, the client, and FIG…IGLC!