Inbound marketing for financial advisors.

It’s a slight twist from the original inbound marketing strategy and subsequent funnel, but the purpose and strategies are basically unchanged.

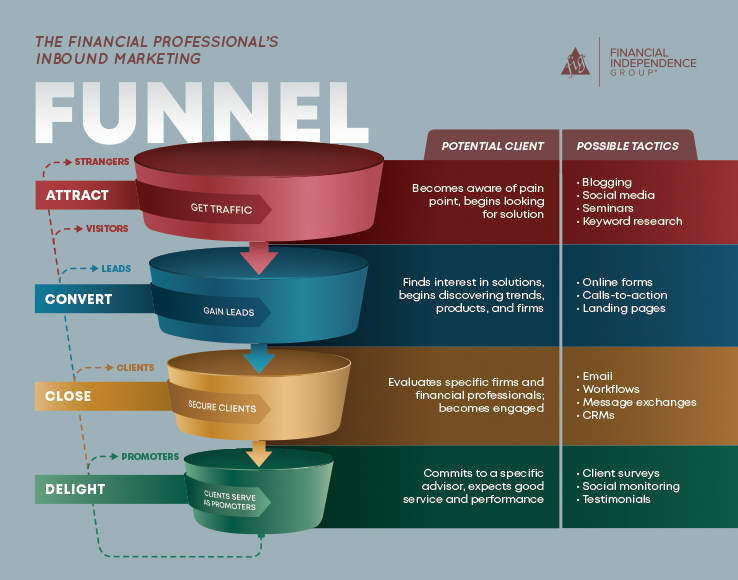

Showing the path of a stranger, to a prospect, to a lead, to a client; but with the distinct flavor an advisor’s marketing strategy can bring, like seminars and client testimonials. The same funnel itself can be broken into three or four pieces, depending on how you look at it.

Here, we’ll be looking at both. Let’s get started.

Top of the Funnel (ToFu): Attract

Referring to the very top of any inbound marketing funnel, the ToFu can be classified as strangers and visitors that attend a seminar, visit your website, social media pages, blog, or the likes.

People in this stage have become aware that there’s a problem in their life (such as not being ready for retirement), and begin to search for answers. These people will research, check out solutions, and get an overall understanding of what they’re looking for.

Here, shed more light on the problem they’re facing. You can do this by having a website with helpful information about your business and services, posting high-quality content on your blog, or have a killer social media strategy – just to name a few.

Related: Seminar Marketing Tips for Better Client Engagement [Infographic]

Middle of the Funnel (MoFu): Convert

Moving into the middle of the funnel, or MoFu, these “visitors” are now “shoppers”.

They’ve done their research and have a better idea of what they need to solve their problem. They’re analyzing their options, and you’re one of them.

To move them along in the funnel, it’s time to focus on them filling out an online form on your website, or maybe convert on a landing page. They still aren’t ready to commit to anything, but they’re getting closer. You’ve been patient thus far, but you don’t want to be pushy.

Now, you’re closing in to convert that lead to a client.

Bottom of the Funnel (BoFu): Close & Delight

You’re close to gaining a new client in the BoFu stage. They’re heavily researched, comfortable, and ready to make a decision. Essentially, they’re on a mission.

That means contacting them is easier now. You can be sending them email campaigns, exchange messages on Facebook, or even have their information in your CRM. It’s now time to close the deal to close those leads into happy clients.

Once they’re happy clients, they’ll enter the “delight” stage, where they’ll share their experience with their friends and family, social media followers, and more. At this point, try to utilize surveys or have them write testimonials so you can learn more about their experience with you. You can even share their kind words so others in the ToFu or MoFu stage can see your value.

Infographic: The Financial Advisor’s Inbound Marketing Funnel

And there you have it. Use this funnel in your day-to-day marketing activities to better understand which actions take clients from a stranger to a promoter.

Is your office looking bland? This infographic would be a great addition. Download your copy here.