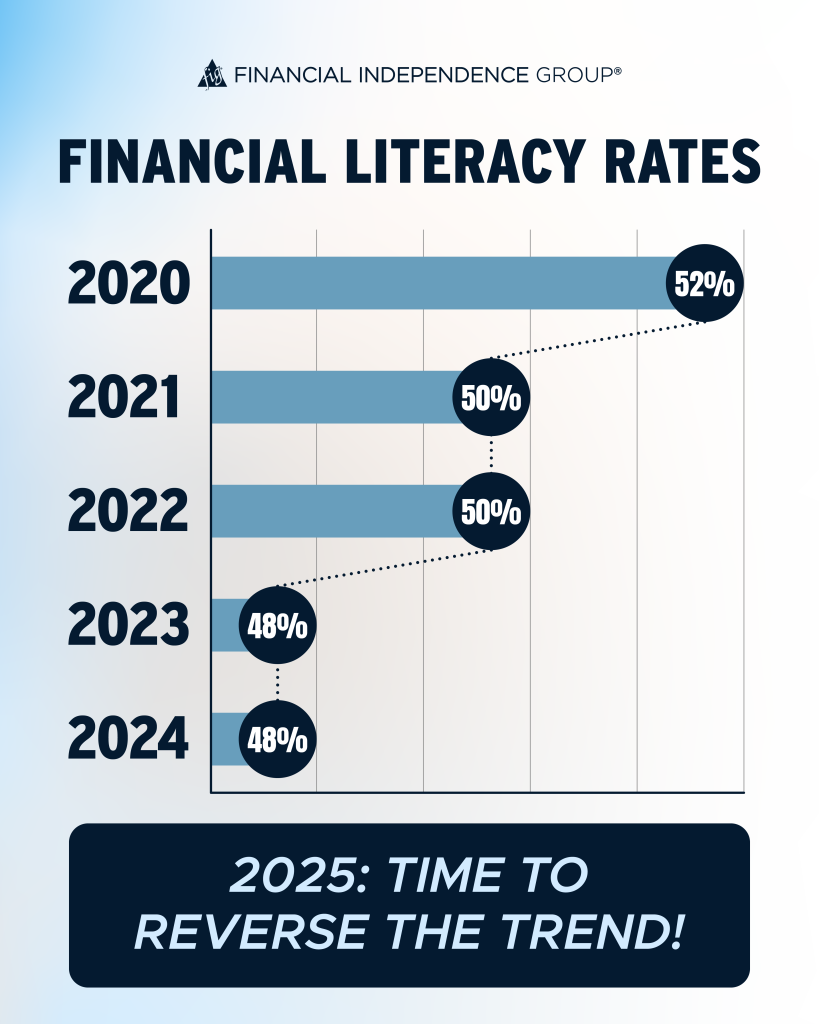

Financial literacy is the key to sound decision-making, yet studies show it’s been steadily declining since 2020. Eye-opening statistics reveal that:

- Over 40% of US adults can’t pass a basic financial literacy test

- 1 out of 3 Americans believe they’ll never retire due to lack of savings and knowledge

- 60% of US adults live paycheck to paycheck, including 40% of those who make over 6 figures

These numbers highlight the underlying issue: many individuals are unprepared for the future simply because they lack fundamental financial education.

With April marking Financial Literacy Month, financial professionals have a timely opportunity to bridge this gap and empower clients to take control of their financial futures. Let’s explore the state of financial literacy today, the most misunderstood financial topics, and how advisors can take action to improve their clients’ outcomes.

Why is Financial Literacy Declining?

Financial literacy has been steadily declining in recent years due to a combination of factors:

1. Changing financial systems

The external evolution of financial tools and platforms has rapidly changed how we interact with money in recent decades. Think: digital banking, crypto, and the decline of cash transactions.

2. The growing complexity of managing money

With rising debt, fluctuating interest rates, and an overwhelming number of financial products available, managing personal finances has become harder, even for financially engaged people.

3. Limited education in personal finance

Over 88% of adults say they wish financial literacy coursework was included in K-12 education, but only 26 states currently require personal finance courses to graduate.

It’s also interesting that 61% of Americans consider their parents a key influence for their own financial knowledge, but nearly half of these parents grade their financial understanding as a C or lower.

This contributes to an ongoing cycle. As innovative technology and regulatory shifts create an increasingly more complicated financial landscape, many individuals don’t have the tools to navigate it themselves, let alone educate the next generation.

What Financial Topics Do Clients Need More Education On?

When it comes to financial literacy, specific topics are more challenging for clients than others. According to a survey conducted by the TIAA Institute, these are the most commonly misunderstood retirement-related topics:

- Medicare coverage of healthcare expenses: Only 30% of adults answered questions correctly

- Life expectancy in retirement: Only 32% of adults understood how long they can expect to live in retirement

- Social Security benefits: Just 42% of respondents were knowledgeable about Social Security benefits

For non-retirement-related topics, fluency varies across different age demographics:

- Understanding and managing risk: Both Gen Z and the Silent Generation only answered 31% of the questions correctly in this category, showing it’s a challenge across generations

- Budgeting and debt management: Budgeting and debt management—Gen Z and millennial clients, especially those considered “high-earners, not there yet” (HENRYs), struggle to balance income, expenses, and debt.

Related: Engaging HENRYs: Strategies for the Next Generation of HNW Clients

How Can Advisors Use Financial Literacy Month to Educate Clients?

Financial Literacy Month is a perfect opportunity to engage clients with educational content and materials that strengthen their understanding of economic concepts.

Here are some practical ways to educate clients this month:

- Social media engagement: Post daily tips or facts like retirement planning tips or simple steps to improve financial health.

- Challenge clients to test their knowledge: Share financial literacy self-assessments or quizzes through social media or email.

- Host webinars: Target topics with knowledge gaps and common misconceptions, like Social Security, managing risk, and life expectancy.

- Offer one-on-one financial literacy sessions: Schedule free consultations or short check-ups where prospects can ask questions and get advice.

Why Should Financial Professionals Prioritize Client Financial Literacy?

- It can boost confidence

When clients genuinely understand complex retirement concepts and strategies, they’re more likely to trust their financial planner and have stronger confidence in their retirement. Education—especially from the financial professional—fosters a sense of security and transparency.

- It can assist in preparing for the Great Wealth Transfer

With an estimated $68 trillion set to be passed down in the coming decades, the next generation will need tools to manage their inherited wealth. Studies show that 90% of wealthy families lose generational wealth by the third generation due to mismanagement. That’s where financial professionals come in: those who target and educate these younger generations can help them sustain and build on their legacies.

- It can provide a level of stability amid market volatility

With ongoing market volatility, rising interest rates, and inflation concerns, many investors feel uncertain about the future. A well-informed client is less likely to make impulsive decisions based on market fluctuations and more likely to stick to a long-term financial plan.

Empowering Clients Through Financial Education

The decline in financial literacy presents both a challenge and an opportunity for financial professionals.

By prioritizing financial education—especially during Financial Literacy Month—advisors can strengthen client relationships, build trust, and ultimately help clients achieve financial security. Advisors who invest in client education won’t just differentiate themselves—they’ll play a pivotal role in shaping a more financially confident and prepared generation.