Updated February March 20, 2024, at 11:16 AM

Put yourself back in 2005. Remember when you could count on your left hand how many carriers had an indexed universal life (IUL) policy?

Flash forward, and the popularity of these products has grown exponentially. We’ve seen most of our core carriers introduce an IUL over the last several years.

Nowadays, it seems everyone has some form of an IUL. In some cases, you can’t count on your left hand how many different IUL product versions one specific carrier has!

It goes without saying that the market for IULs has become overly saturated. Here at Financial Independence Group, we work with over 75 carriers who offer an IUL. Needless to say, that means there are a ton of options. So we always keep our finger on the pulse on what’s most competitive as we work on cases every day.

I can confidently say that we find the ideal solution in each case. For example, we’re in the “top 10” with 15 of our core carriers, but we’re not #1 with any carrier.

So today, we’re going to look at IUL fees and charges, and why IUL illustrations matter when explaining the IUL fees to your clients. Let’s dive right in.

Looking at Actual IUL Costs

When we do our due diligence on the IULs offered in the market, we focus on the carrier’s strength. Precisely, we dial into financial stability and historical data on how true they’ve stayed to their product’s promises.

We also look at the product’s moving parts—for example, index options, loan provisions, and additional riders or benefits. The last big focus is the total cost of each product, along with the charges of the IUL. We want to look at the client’s actual cost and how factors or IUL charges might play into the total price, such as non-guaranteed bonuses on interest rates.

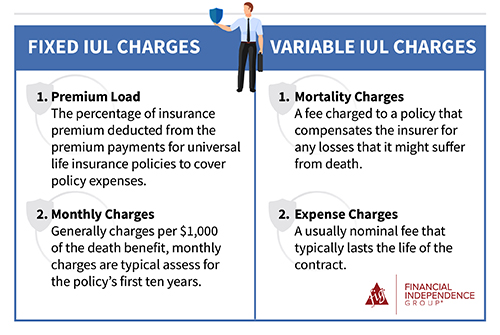

I wrote an article several years back on IUL charges and fees. To briefly cover this again, we break down the costs into fixed and variable expenses. The fixed IUL charges are the premium load and monthly charge. The variable IUL fees are the mortality charges and expense charges. These charges are common across all IUL products.

IUL Charges & Fees Deducted

Illustration Manipulation Affecting IUL Costs

What’s recently become apparent is that there’s a possibility for illustration manipulation that can impact the cost of the proposed IUL and mislead clients on what actually to expect. This impact has resulted in new regulations being rolled out almost overnight.

The two main ones I focus on are interest rate bonuses and multipliers. So to keep it as simple as possible, these internal offerings of the product allow for greater return potential, but in many cases, there are several moving parts for these benefits to kick in.

What happens is the illustrations show significantly higher cash values and income projections. If certain returns of the index or premium payments aren’t made, the projections wouldn’t be true.

Related: Finding the Right Indexed Universal Life Policy

Why Conservative IUL Illustrations?

I think back to a case where the competition’s illustration was reflecting $40,000 more in income every year. Of course, I understood what was happening and honestly could have illustrated it the same myself, but that’d be misleading. Full disclosure: the multipliers and bonuses can happen, of course.

It’s just not something I was comfortable illustrating for a client because I strongly believe in being overly conservative with every sale. You, of course, can also explain and illustrate the potential. We do that as well, but I always lead and finish with a conservative mindset. Under-promise and over-deliver!

The number one impact of IUL costs you should remember? The cost of insurance is entirely based on the net amount of risk. This is known as the difference between the death benefit and the internal cash values.

It’s important to note that the cost of insurance is the greatest expense to the client over the policy’s life. As always, the higher the case value, the lower the net amount of risk.

Suppose you have higher returns in an IUL illustration that allows for a better-proposed income and cash accumulation. That’s because the net amount of risk is so much smaller than a conservative IUL illustration you’d get from me.

Even at the conservative assumption and costs, the proposals still make all the sense in the world for the client. It should be a viable vehicle to their overall financial plan. I know when a policy is placed in force, there’s a real chance the projections delivered to the client will be much better.

Remember This About IUL Fees & Costs…

When looking at fees or charges when you’re considering an IUL for a client, make sure you fully understand your clients’ total internal costs. And, be able to can quickly explain them. Just as important is that you understand the projections you’re illustrating and how that impacts the IUL’s costs.

IUL policies will continue to grow in our industry. I see it gaining traction in areas it never has. Like the investment advisory world where I have the honor to work with some of the most talented individuals in our industry.

Let us all be well educated in the products we’re offering to our clients. And put together financial plans with a well-established foundation—one that underpromises and overperforms.

Keep Reading: Life Insurance Policy Reviews for Clients [CAR Program Overview]

The content within this presentation is for educational purposes only and does not represent legal, tax or investment advice. Customers should consult a legal or tax professional regarding their own situation. This presentation is not an offer to purchase, sell, replace, or exchange any financial product. Insurance products and any related guarantees, features and/or benefits are backed by the claims paying ability of an insurance company. Insurance policy applications are vetted through an underwriting process set forth by the issuing insurance company. Some applications may not be accepted based upon adverse underwriting results.