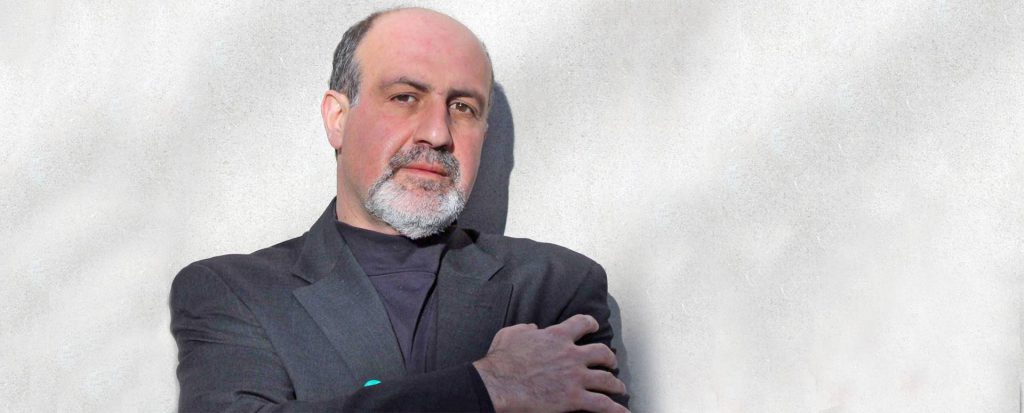

Few people in the finance world provoke more intense reactions than that of Nassim Nicholas Taleb.

For those unfamiliar, he’s a famed statistician, author, academic, former risk analyst, and trader. If you don’t believe that he’s controversial, head over to his Twitter account and take a scroll through his feed.

You’ll see he regularly goes toe-to-toe with Twitter laymen while trading heated exchanges with other intellectuals. And not just intellectuals in finance, but scholars in a seemingly endless field of subjects. It quite poetically fits then, that some of the best arguments for annuities can come from the thoughts of Nassim.

“Skin in the Game”

One of his most recent works has been his argument revolving around the concept of having “skin in the game.” To summarize the central idea of his “Skin in the Game” work, Taleb puts it on his Medium page as “owning one’s risk.”

In other words, you don’t just encounter the consequences of your decisions, but must fully live through and experience those consequences first-hand. The further a person is removed from the consequences of a given decision, the less the full scope and impact of those potential consequences will factor into their decision-making process. As a result, human experiences can become just numbers on a computer screen. One that often sits in a brightly lit office with a potentially nice view.

How can this apply to the world of financial services and the products that clients are advised to be in? The two key words are “be in.”

Financial products and assets are like buying a house: you have to live in the thing moving forward. Only clients don’t see their assets or products as a house because financial assets are numbers and words on paper, leaving everyone to subjectively understand what precisely these assets or products are. How each person views those numbers and words depends on a myriad of factors, including the language their financial professionals use to describe them.

To complicate it more, throw in the fact that humans are messy. This alone is the main underlying factor that has thrown the Nobel Prize-winning wrench into the idea that entirely rational decision-makers determine markets and economics. Financial professionals are tasked not just with getting the most significant number on a computer screen but also fully understanding their clients. A task that even psychologists struggle to accomplish.

Applying to Annuities

Now let’s look at applying this to annuities, perhaps the most controversial product in finance.

Annuities are often said to be complicated. It’s even more true with certain types of annuities. However, a lot of this viewed complexity is more from the financial professionals’ standpoint than that of the client. That’s because annuities differ from most other financial products and assets that financial professionals work with daily. Insurance companies offer them. They’re taxed differently. But most importantly, they can’t be sold on the market after purchase because they’re contracts and not ownership of an asset.

Related: How to Gain Client Interest in Annuities [Infographic]

This asset versus contractual obligation distinction is where human messiness and Nassim Taleb’s Skin in the Game come into focus. How the average person views assets compared to a contract is going to be different from your average financial professional.

In terms of human messiness, consider that many financial professionals usually aren’t strictly numbers- oriented people; but people who were attracted to the entrepreneurial style of running a financial practice. How they view market risk and risk, in general, is different from the average person.

“Owning One’s Risk”

Now let’s throw in the Skin in the Game concept of “owning one’s risk.” Sure, it stings when a financial professional’s assets under management income go down in a market downturn. However, it hurts A LOT more when that money is the life savings that you’re well-being is dependent on for the rest of your life. What can be viewed as a bad year for you could be a nightmare year for your client.

Perhaps you’ll correctly point to the history of the market going up in the long-term. But let’s consider this: the history of the American stock market is incredibly small in the whole of human history. The idea that people can always count on the market the rest of their lives can be quite naïve from a historical standpoint. Do we really think the public and the politicians they elect will continue to politically favor corporations the way they have the last few decades? Especially with the declining amount of trust in our society that’s driving much of the polarization in politics?

Think about the plethora of ways simple tax changes could impact corporate growth in the future. Consider the rise of artificial intelligence. What will the economy look like in 30-40 years? It certainly won’t resemble the one of the past that created the beautiful upward curve of the hockey stick S&P 500 chart.

Annuities and Guaranteed Income

None of this is to say that annuities are a perfect solution to it all. It’s to say that the idea of guaranteed income for the rest of one’s life can make many people breathe substantially easier by removing the cloud of doubt that sits over their heads during market downturns. So just like people, the gravity and darkness of each person’s perceived cloud can change for them as their life inevitably changes. People may think they can handle downturns during their working years when they’re healthy. How they view downturns if they’re retired and potentially sick could be drastically different.

Related: How Annuities Can Address Client Issues

Annuity advocate and Financial Independence Group’s Retire Happy Now partner, Tom Hegna, often says, “Assets make people miserable.” That may sound like a typical annuity pitch to us in the finance world, but there’s a tremendous amount of truth to it. Because something that many annuity people know that the rest of the finance world forgets is that the vast majority of people don’t want to become forced economists once they retire. That’s one of the unexpected outcomes of the decline of pensions.

Skin in the Game can even impact which annuity a client may want to choose. For instance, several factors could be wise in choosing a company with a slightly lower payout if it contributes to a client’s sense of well-being.

A few good examples could include:

- A company that doesn’t have a constant history of customer-service headaches

- Choosing a mutual company over a stock company

- Choosing a company with higher financial ratings

- Even choosing a well-known and trusted brand name

Brand names could even apply to some of the indexed annuities with proprietary indexes built by renowned economists.

See More: Indexed Annuities are Set to Soar [Infographic]

Bottom Line

Ultimately, this is why annuities require more than just numbers. Their unique structure and offerings require consideration outside the realm of “Well, here’s what the market has historically done.”

They require considering history, politics, psychology, and technology—along with other factors and uncertainties that all potential outcomes can create. They involve humbling ourselves to admit that as smart as we perceive ourselves, the future—and all its possible results—is driven by more factors than we’ll ever know.

Reach out your private client group or contact us to learn more about annuities and their unique product structures.

Annuity products and related features, benefits and/or guarantees are backed by the claims-paying ability of the issuing insurance company.