11K

Call us at (800) 527-1155 or contact your private client group

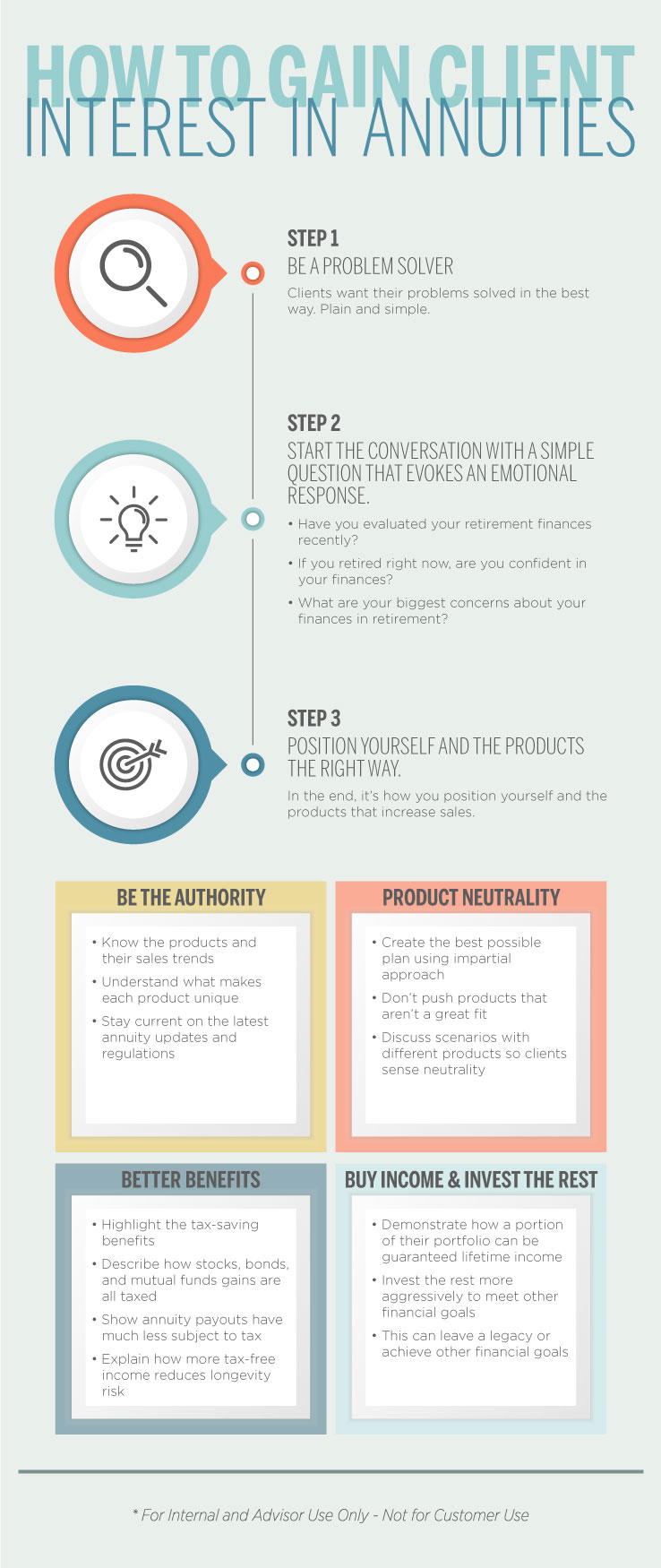

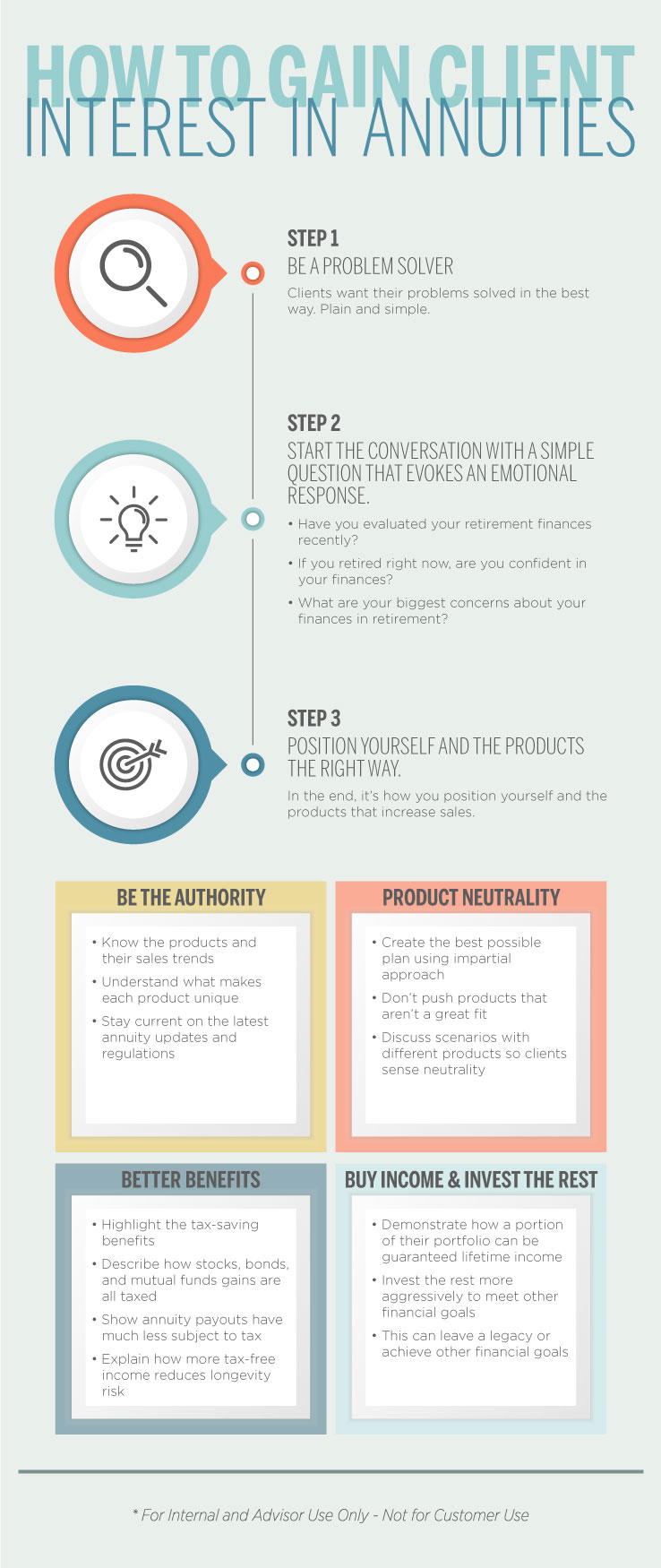

Are your clients unsure of annuities? Want to know how to pique their interest in these income-producing products?

The helpful tips below can increase your chances of closing more annuity business with your clients.

Here are the first three steps:

- Be a problem solver.

- Start the conversation with a simple question.

- Position yourself and annuities the right way.

Check out the infographic for more detail.

Related: Annuities & Peace of Mind

Call us at (800) 527-1155 or contact your private client group

to learn even more tips on increasing client interest in annuities.