Updated June 4, 2025, at 11:08 AM

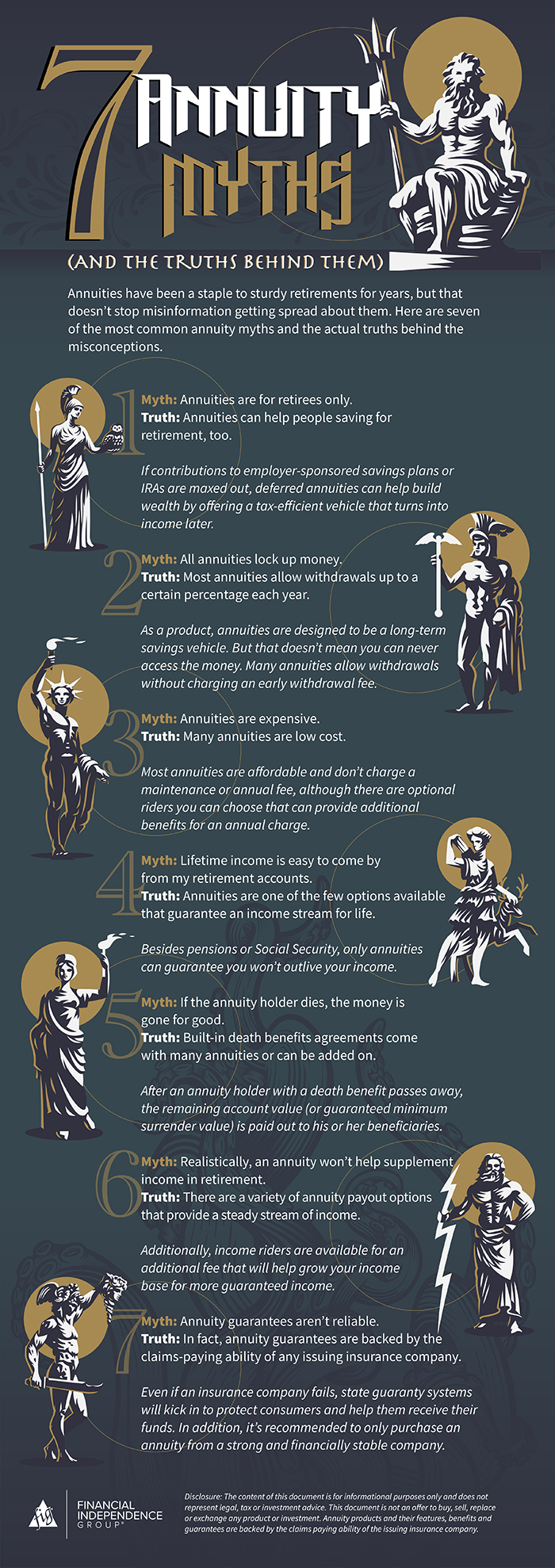

Annuity myths have circulated inside financial (and client) circles for years. From misconceptions about what annuities are or how annuities address client issues, those who explore annuities for retirement planning may have to sift through some misinformation about the financial product.

But the truth is, annuities help to diversify retirement portfolios and are one of the few financial solutions that address guaranteed income for life. This is becoming especially important as longevity risk plays a bigger role in annuity and retirement planning for clients across the country.

Because of that, it’s important to separate annuity myths from the actual truths about annuity benefits. Here are seven of the more common annuity myths:

Myth #1: Annuities are for retirees only.

Myth #2: All annuities lock up money.

Myth #3: Annuities are expensive.

Myth #4: Lifetime income is easy to come by from retirement accounts.

Myth #5: If an annuity holder dies, the money is gone for good.

Myth #6: An annuity won’t help supplement income in retirement.

Myth #7: Annuity guarantees aren’t reliable.

To see the truth behind these seven annuity myths, check out the infographic below.

Click here to download and share this infographic with your clients.

Keep Reading: Annuities Help Protect Against Longevity Risk