Updated August 6. 2024, at 1:28 PM

Indexed universal life (IUL) vs. whole life insurance: which one is more beneficial and what are the differences?

The truth is, “best” is often subjective in insurance. It all depends on a given situation. Let’s explore the IUL vs. whole life discussion and look at the pros and cons of each, while comparing them to see what product category may be best for a client.

First, both policy types are a form of permanent cash value life insurance. The cash value is tax-deferred with tax-free accessibility via withdrawals to basis and/or loans.

The differences come from the policy guarantees and how the cash value is credited annually through either indexed performance or dividends.

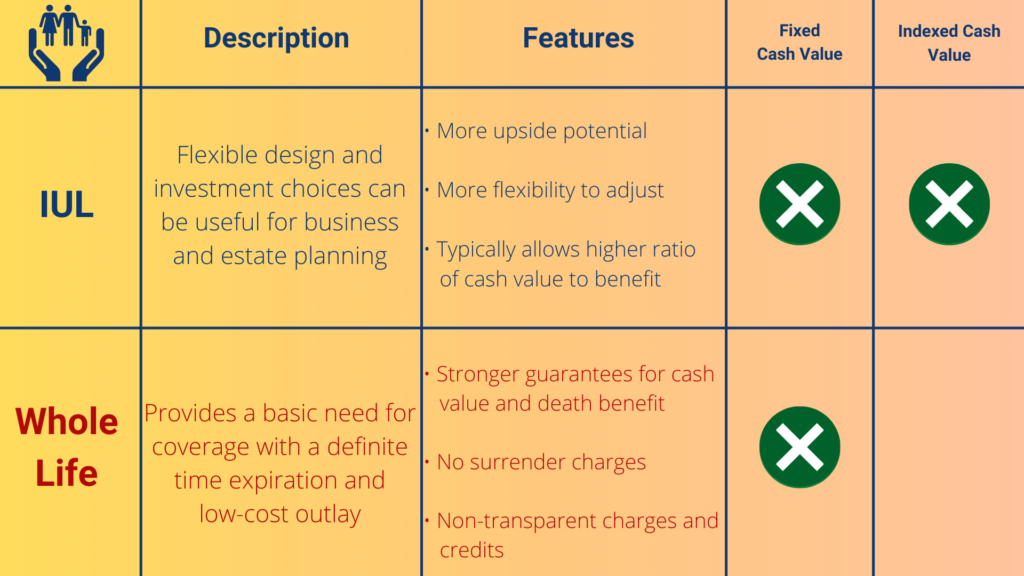

IUL vs. Whole Life

At a high level, an IUL insurance policy includes a death benefit and a component that’s tied to a stock market index. The policy’s cash value rises or falls depending on the performance of that index.

Conversely, whole life insurance provides permanent death benefit coverage for the life of the insured. In addition to paying a death benefit, whole life insurance also contains a savings component in which cash value may accumulate.

So What’s the Indexed Part?

IUL policies use subaccounts linked to various market indexes such as the S&P 500 to help grow cash value. If these linked accounts perform well, the insured receives interest credit based on cap and participation rates.

Cap rate is the maximum rate of return that can be earned on an index.

Participation rate is the percentage of positive index movement credited to the policy.

If they’re down for the measured period, the insured receives 0% interest which is commonly the floor and provides downside protection.

IUL vs. Whole Life Comparison

Related: A Look at IUL Fees, Costs, & Illustration Manipulation

Notes to consider:

1) Premiums for whole life and IUL are higher than term insurance to create level premiums through life expectancy.

2) Internal policy expenses are lowest in earlier policy years and increase as the insured ages.

3) Cash value represents the excess premiums and earnings on investments from the policy’s early years to create reserves above the policy’s internal expenses to offset increased costs as the insured ages.

4) Although IUL policies are more transparent and flexible, several whole life options offer built-in premiums that make them “adjustable whole life” policies.

IUL Pros & Cons

| Pros | Cons |

| • Higher flexibility • Upside to earn a higher rate of return • Lower expenses based on “net amount of risk” | • Must be managed annually • The cost of insurance rises with age • Less predictable returns |

Whole Life Pros & Cons

| Pros | Cons |

| • Stable fixed premiums • Guaranteed death benefits • Set-and-forget with predictable returns | • Mandatory premiums • Guarantees equate to higher costs • Slower cash value growth |

The Importance of Policy Design for IUL and Whole Life

The design of each policy plays a role in determining which is best for a particular situation. It’s important to have conservative projections and stress testing to safeguard policy goals.

Cost of Insurance & Lapse

The cost of insurance is taken every month from the policy’s cash value. It’s the amount needed to keep the death benefit and policy in force.

Lapsing of the policy is when the policy is canceled, and no benefits remain. Lapsing occurs when there’s not enough case value to sustain ongoing charges.

Surrender Value

The surrender value is the amount of cash value the insured has access to at any point in time. Surrender charges often apply to IUL policies in the early years on a decreasing schedule.

IUL vs. Whole Life Conclusion

Overfunded IUL or whole life policies provide death benefit protection while offering tax-deferred cash accumulation potential.

IULs have more flexibility and unique crediting strategies for growth, while whole life is steady and offers consistent returns with more guarantees. In short, the best policy type will depend on a person’s needs and goals.

Reach out to your private client group today, or get in contact with us below to learn how our product experts can assist you with your planning needs.

Keep Reading: Life Insurance Policy Reviews for Clients [CAR Program Overview]

The content within this document is for educational purposes only and does not represent legal, tax or investment advice. This document is not an offer to buy, sell, replace or exchange any product. Customers should consult their tax or legal professional regarding their own unique situation.

Insurance company products (including life insurance, annuities and long-term care) and their related features, benefits, and/or guarantees are backed by the claims-paying ability of an insurance company. Life insurance and long-term care policy applications are vetted through an underwriting process set forth by the issuing insurance company. Some applications may not be accepted based upon adverse underwriting results. Customers should carefully review all product information with their financial professional prior to purchase.