Updated July 27, 2022, at 3:49 PM

Case Study Background

As I’m sure you’re aware, clients often believe self-funding for long-term care (LTC) is the only option when it comes to LTC planning. And because of that, they’ve likely earmarked assets or personal savings towards achieving that goal.

This is a great start to their care planning needs, but it likely won’t be enough based on the current rising costs for LTC.

Talking about leverage and tax efficiencies using insurance is typically based around positioning an asset-based LTC plan. However, clients can’t physically see or fully comprehend the advantages. Why is that?

Well, sometimes seeing is believing.

While illustrations can be confusing, the images below briefly touch on some of the advantages to leveraging a client’s given asset on a fully guaranteed basis, and showing the leverage effectively.

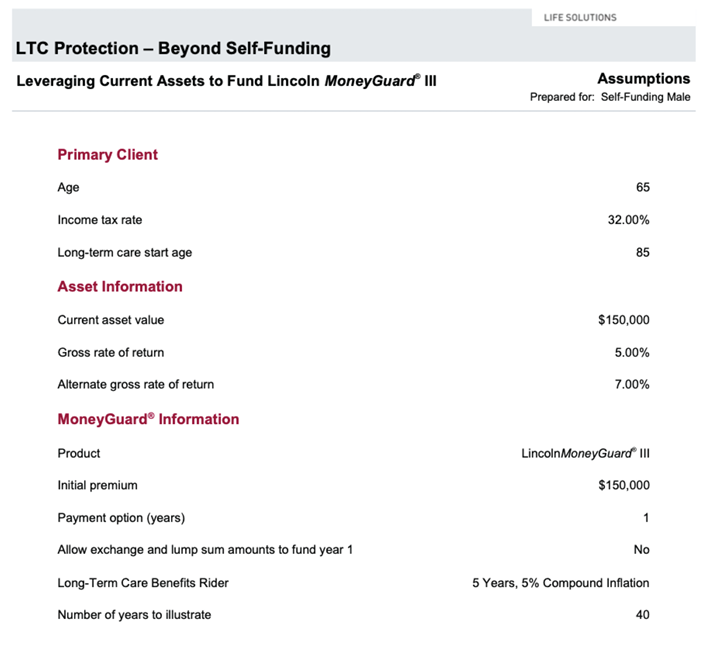

Let’s dive into this hypothetical LTC case study.

LTC Case Study Details

- 65-year-old male

- Earmarked $150,000 asset

- Asset expected to grow in 5-7% range

- Wants to cover LTC expenses

More Assumptions

Related: Repositioning Asset-Based Long-Term Care Products [Case Study]

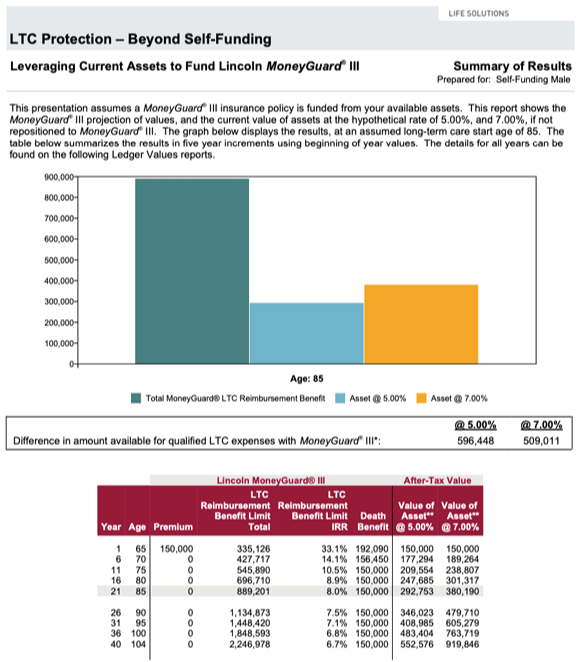

Case Study Summary of Results

LTC Planning Solutions

Given the client’s age, the Lincoln Financial MoneyGuard® product will provide the additional leverage he desires at a guaranteed rate.

By age 85, the client’s $150,000 turns into $889,000. He’ll also know have access to over $12,000 a month—tax-free—for long term for a minimum of five years.

Case Study Conclusion

With this $150,000 asset, the client can now grow and fund most of his LTC needs, assuming he’ll need some form of care around ages 80-85. The graph and illustrative columns will show the client’s desired outcome versus utilizing insurance.

So, the questions become: Would a client prefer to potentially leverage their asset 2-2.5x to help pay for future care by staying in the market?

Or, would they prefer to leverage the same asset nearly 6x, on a guaranteed basis?

Keep Reading: 12 Long-Term Care Statistics That Can Spur Client Action [Infographic]

This case study is a hypothetical example. For advisor use only. Not for public or consumer use.