Updated September 18, 2023, at 1:34 PM

In the spotlight for this case study is asset-based long-term care (LTC).

Given the current environment, we’re experiencing ups and downs in the market. This volatility can make clients hesitant about moving money and getting “stuck” in a product that might not fit their needs down the road.

With the selection of products from the FIG Care Planning Division, financial professionals with a CFP® license or other designation that allows for developing a comprehensive financial plan can help clients position their assets to overcome this common objection.

Let’s look at how we can position some care planning products that:

- Are desirable to clients that want access to all their money (prior distributions not included) if their situation changes

- Leverage for qualifying care as well as death benefit if care isn’t needed

- Attractive to clients currently with CDs, money markets, or savings accounts

- Appealing to those with a low risk tolerance or choose to self-fund

- Provide tax advantages

LTC Case Study Details

Related: What’s the Best Long-Term Care Insurance Solution? [Infographic]

Care Planning Solution

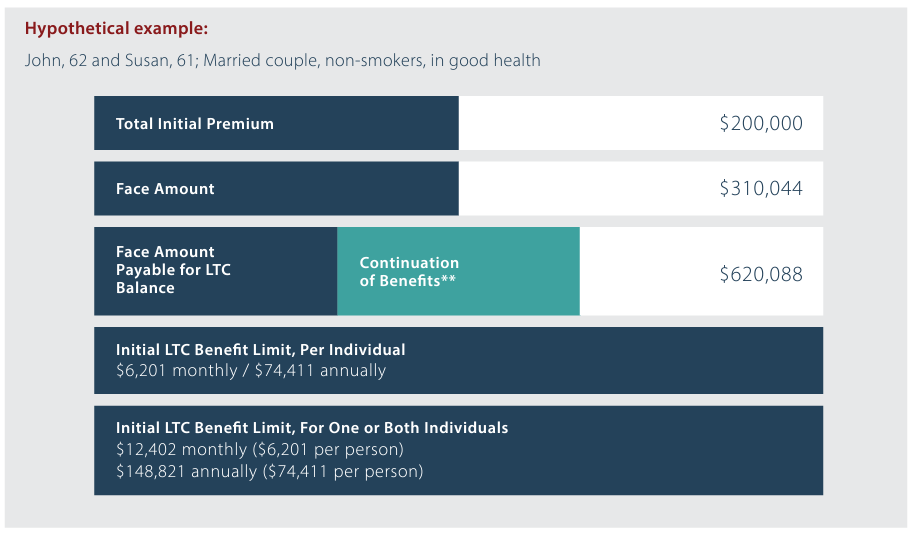

Repositioning $200,000 of the client’s existing assets into a single-premium OneAmerica® Asset Care® policy can immediately provide a total of $620,088 for care.

The initial premium, minus any prior distributions taken, is available to the client at any point if they change their mind, need access to their funds, or never need care.

Case Study Conclusion

Since the 2008 recession, John and Susan have become more conservative and don’t prefer any strategy that would limit access to their funds. They have several accounts that provide low returns, but they’re comfortable knowing that they offer guarantees and flexibility.

OneAmerica Asset Care with Return of Premium is a whole life insurance policy that allows access to 100% of the life policy death benefit to help pay for qualifying LTC expenses.

Now, John and Susan have access to 100% of their money, while also leveraging those dollars into a tax-free pool that can be used for any qualifying care.

Note: For this asset-based long-term care case study, if the client does access “their money,” or the cash value of the policy, both the death benefit and amount available for qualifying LTC expenses would decrease.

Keep Reading: Leveraging Current Assets to Fund Long-Term Care [Case Study]

This case study is a hypothetical example. For advisor use only. Not for public or consumer use.