Updated August 7, 2024, at 3:37 PM

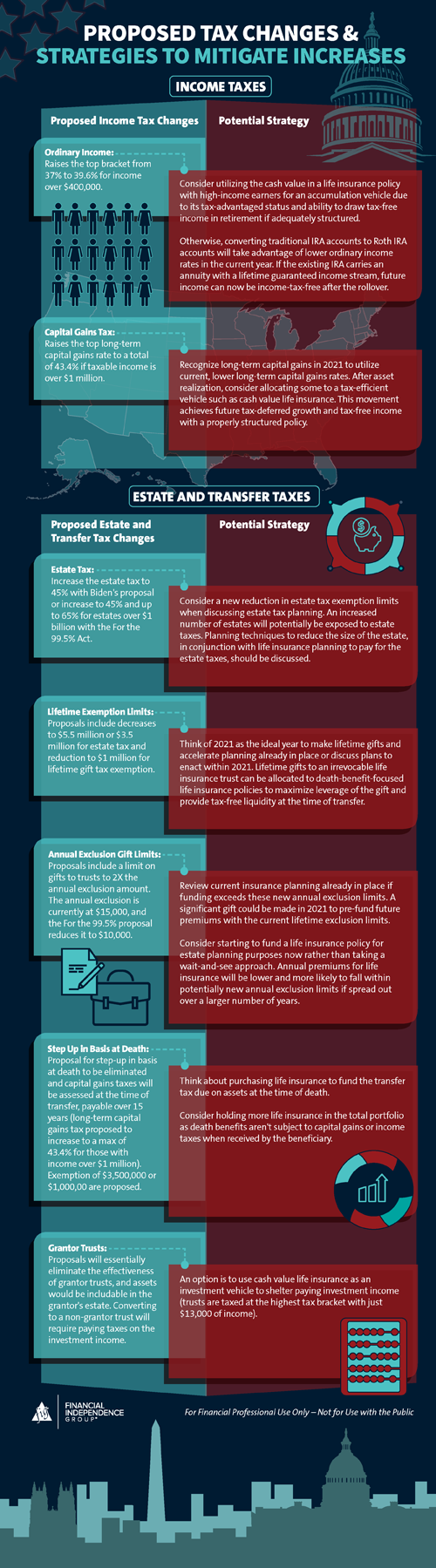

With several legislative changes to the current tax laws, most everyone agrees there are some significant changes on the horizon. The Made in America Tax Plan, the For the 99.5% Act, and the tax changes proposed during the election by the Biden Administration make for an environment of uncertainty, especially for high-net-worth individuals.

No one knows exactly where all the proposed changes will end up, and initial concepts will likely evolve as they move along in the legislative process. Still, we can begin looking for solutions to the questions clients are asking their financial professionals.

Below, we look at some of the available planning solutions using life insurance to soften any tax-increase blows. Asset allocation, tax efficiencies, and how assets transfer at death become just as important as the potential investment’s projected performance and risk level.

Life insurance has been, and it appears it’ll remain, a unique vehicle that allows for tax-deferred growth, tax-free distributions, and a tax-free death benefit if properly structured. Moreover, the 2021 updates to Section 7702—the decreased minimum death benefit required by the IRS to obtain these tax advantages—make these life insurance benefits even more favorable for investors. Meaning there’s less drag in the form of policy charges and more benefit to the policy owner.

Related: Section 7702 Changes: The Saga Continues

Plan Proactively With Life Insurance Policy Reviews

Bringing up these conversations now with clients allows for insight into any previous planning and proactive planning for future priorities. For example, how might any of the proposed tax law changes impact their current plan, or will changes require a new one to be put in place? With estate tax limits currently higher than they’ve ever been, many clients haven’t focused on the need for estate planning.

If life insurance is a part of their current plan, FIG-partnered financial professionals can utilize our Comprehensive Analysis and Review (CAR) program to check for necessary changes or to confirm it’s performing as anticipated.