Updated April 4, 2023, at 12:31 PM

Our Comprehensive Analysis & Review (CAR) program can help you guide your clients in the review of proposed or existing life insurance policies, and then adjust them for changing needs while considering alternatives.

And it takes just seven easy steps to implement CAR.

In particular, you can help your clients manage their policies in or near retirement when needs typically change from income protection (in case of early death) to protecting and maximizing policy values and benefits for longevity. For clients who plan to take policy distributions to supplement retirement income, this guidance includes how to manage the policy for optimal use.

Client Life Insurance Policy Reviews

A policy review should have four key aspects:

- Insurance tailoring: Should coverage be increased or decreased?

- Cash value peak: Does the cash value keep growing or start to decrease?

- Premium opportunity: How much premium can be added to leverage growth?

- Review credits, loan, and withdrawals: How are credits added and what are plans for distributions?

Use this key question to maximize long-term value and benefits: Would your client prefer to add more premiums or reduce the current insurance amount if needed?

Related: How Life Insurance Loans Work

Insurance Tailoring

Insurance tailoring refers to adjusting the policy benefit based on a life cycle of needs and resources. Life insurance should be balanced by the ability to pay premiums to optimize long-term values and benefits.

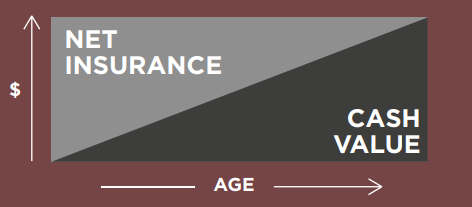

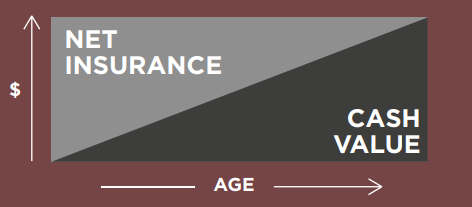

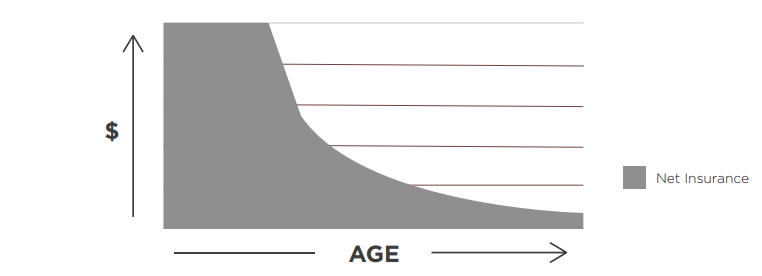

A key concept is that a life insurance benefit is a combination of insurance and value as shown in the graph below. The insurance amount may start as level with value added on to increase the benefit.

Eventually, the insurance amount should decrease due to changing needs and increasing costs of insurance as you age. We’ll display product types that provide cash value versus internal values for the death benefit and not available in cash while living.

Prior to retirement, financial advisors typically recommend clients have life insurance coverage that equals five to ten (or more) times their income. A combination of term and permanent insurance is often a good combination to provide this coverage.

As one nears retirement, the need for income replacement in case of an early death typically makes a critical change toward preserving or maximizing values for a long life. This principle applies whether the policy is kept only for the death benefit or also provides retirement income.

Typically, term insurance coverage is dropped or reduced in retirement years when premiums would increase dramatically. In the graph above, the insurance portion can be covered entirely by term insurance and the value portion can represent an accumulation of retirement assets or income separate from a life insurance policy. For cash value life insurance, the ability to provide a permanent benefit depends on building value, and eventually, decreasing the insurance amount.

Cash Value Peak

The cash value in a UL policy declines from a peak when the policy costs exceed the current average credits and premiums paid. This is a key decision point for policy changes.

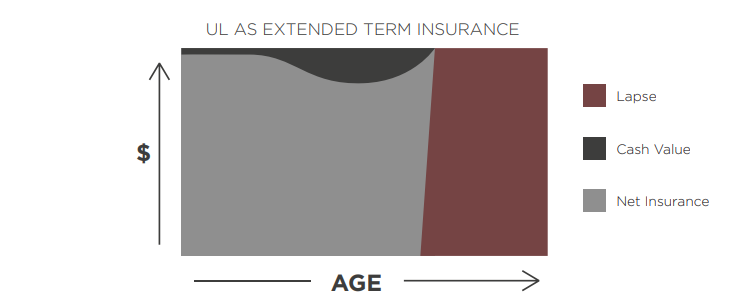

By this point, you should either put in more premium to keep the policy going or reduce the benefit unless you’re comfortable with having extended term insurance (ETI). When cash value reaches a peak, the policy typically would last only about ten more years.

An exception to a policy lapsing with zero cash value is with guaranteed universal life (GUL), or other products with secondary guarantees to maintain the death benefit even if the cash value is below zero. However, these policies do have internal account values that need to continue increasing to support the secondary guarantees. A GUL policy should be checked regularly to see if the premiums paid keep up with the expected guaranteed benefit.

Related: Is Cash Value Part of the Death Benefit? [Infographic]

If a policy has enough cash value, you can take distributions to supplement income. These distributions will typically reduce the death benefit and the cash value. If credits are greater than the income taken, then the cash value can continue to grow. Although, values and benefits would be less than what they would have been without taking the income.

If your client plans to regularly take income from the policy via loans or withdrawals, you should consider minimizing the death benefit within tax limits in order to minimize costs and maximize income.

Premium Opportunity in Life Insurance Policy Reviews

When reviewing a life insurance policy, you should consider the opportunity to add more premiums, particularly for UL insurance that has flexible premiums and adjustable benefits.

This opportunity may seem counterintuitive, but paying higher premiums reduces insurance costs and maximizes long-term cash values and benefits. Review policy statements and in force illustrations to see the premium opportunity for how much can be added to the policy now or over the coming years.

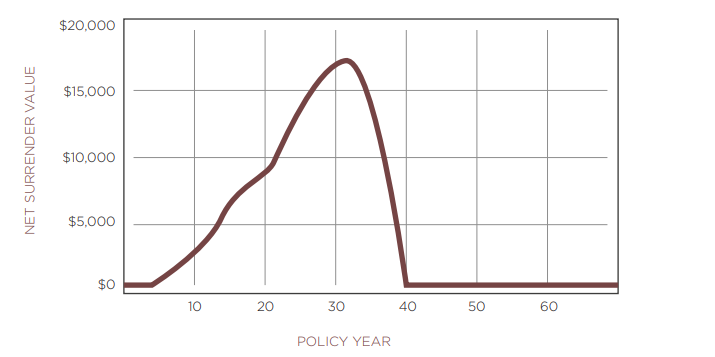

For example, a UL policy may have a level benefit of $200,000 with $40,000 in cash value. The $160,000 difference between the death benefit and cash value is the insurance amount and is used to determine costs. The policy was issued years ago when interest rates were much higher and now the cash value is less than originally projected. The policy is projected to last a limited number of years with a big risk of the insured outliving the policy without any benefit to the beneficiaries. It’s essentially ETI. The red in the graph below represents a policy lapse at a future age when the value in black is depleted.

To avoid a policy lapse and to build cash value, premiums can be added over time or as a lump sum.

In this example, the policy has maximum premiums that would allow $40,000 to be added to the policy. Adding the premium then doubles the cash value and reduces the insurance amount to about $120,000 so that costs are reduced by about 25%. The cash value then continues to grow, making it permanent insurance that would last until death (or be available to use as cash value if needed).

Many older UL policies have guaranteed interest rates of 4% or higher so this premium opportunity may provide a solid return that’s particularly attractive in a low interest rate economy. Check on what the premium load would be for adding premiums.

Premium Opportunity with Term or Whole Life Insurance

Term Life Insurance

Term insurance typically has an opportunity to convert to a cash value life insurance policy. This option should be considered before the term policy ends its low premium period and goes to a premium that can be 10 to 20 times what the original premium was. Consider the opportunity to convert to a policy where premiums build cash value and provide a permanent benefit.

Whole Life Insurance

Whole life insurance may have options to add extra premiums or apply dividends to purchase paid-up additions. A whole life policy is designed with a fixed premium that makes it permanent insurance with cash value growing and the internal insurance amount decreasing.

If policy loans have been used to pay the base premium or to provide distributions, then the opportunity to repay loans should be considered to build long-term value and benefits particularly if the loan is charged at a rate higher than what’s applied to the cash value that supports it.

Policyholders should be strongly encouraged to fund UL policies (other than GUL) near the tax limits in or near retirement. The policy may start with a minimum or target premium and then later be funded near the maximum premium to maximize cash value and long-term benefits.

Exceptions occur when the client only wants or needs the policy to be ETI. In cases where the insured’s life expectancy has declined, the term coverage may be long enough to reasonably expect a benefit.

GUL is an exception to this principle of building cash value but does require a premium that builds internal values that follow the principle shown in the graph above. GUL is focused on guaranteeing a leveled death benefit and no cash value.

Be sure your client has set up automated premium payments that are checked to be sure this coverage stays in force. Failure to pay the premium, particularly at older ages, results in a tremendous loss in economic value. Verify if the policy allows prepayment of premiums for the guarantees or whether there is actually a prepayment penalty.

Related: Q&A: Life Insurance Policy Reviews

Insurance Tailoring: Adjusting Benefits

Problems with Low Cash Value in Retirement

Problems with cost and difficult decisions occur for life insurance policies with low cash values during retirement. As previously noted, GUL is an exception as long as the premium is paid.

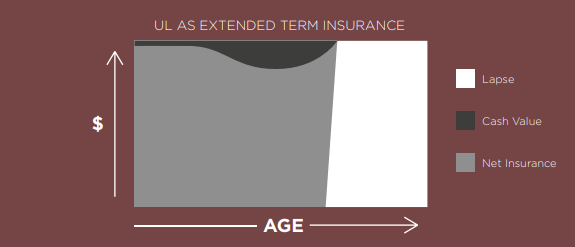

For UL as ETI, the following graph shows how the low cash value in black is depleted. When it reaches a peak, the policy may last about ten more years. Costs are based on the insurance amount (in gray) and the cost per thousand rises with age. The policy lapse is shown in white for ages where there’s no benefit.

Consider the prior example where a UL insurance policy with a level $200,000 benefit has $40,000 in cash value in retirement. If the policyholder isn’t willing or able to add enough premiums, then reducing the benefit is typically prudent. The exception is when life expectancy has declined and the insured is unlikely to outlive the benefit.

In this example, the death benefit may need to be reduced from $200,000 to $80,000 to allow the $40,000 in cash value to continue to grow. Eventually, the cash value may grow enough so that the death benefit is increased above $80,000. The policy preserves the option to use cash value in case it’s needed or to keep all values to support a permanent death benefit.

Choosing to reduce the face amount to $80,000 can be a difficult decision as a death earlier than expected may occur and the beneficiaries would have $120,000 less in benefits. Insurance companies require the policyholder request each face decrease so you typically can’t request smaller decreases occur over the years to provide a smoother transition.

The prudent and practical choice may be to make a large enough decrease to allow the policy to grow and provide a permanent benefit.

Increasing to Level Death Benefit

The increasing death benefit option for UL policies has a level insurance amount where the account value is added on to provide the total death benefit that increases due to account value increases.

It allows about two to three times as much premium to be paid into the policy compared to a level death benefit option. However, if not enough premiums are paid or credits added, then the account value will decrease and cause the death benefit to decrease from the prior total. If the account value is depleted, then the policy will lapse.

Typically, you should switch from the increasing death benefit option to the level death benefit option in retirement unless you’re still funding the policy near the tax limits. You may also need to decrease the face amount with this level option if the account value wouldn’t be enough to keep the policy going over the following years.

When a level benefit policy is properly funded, the death benefit can eventually increase due to cash value growth. Whole life can provide an increasing death benefit when dividends purchase paid-up additions. Then these additions have a guaranteed increasing cash value that decreases the internal insurance amount.

Review Credits, Loans, and Withdrawals

Variable and Indexed Universal Life: Actual Patterns of Credits and Income

Indexed universal life (IUL) provides an upside for index credits while guaranteeing no investment loss. In contrast, variable life products have subaccounts that may provide a higher credit in a particular year but may have losses in other years. See the policy illustrations and product guides for how the indexes or subaccounts work.

When you review a policy statement for an indexed product, keep in mind that if there is an index credit for an account, the credit typically won’t show up until the end of the index year. So you need to look at when the premium was paid into the account.

Illustrations of IUL cash value growth or income are typically based on an assumption of a level credit rate. The results will vary each year. Some years will have no credits. In other years, the credit will be higher or lower than the illustrated average. If you start taking income from the policy, then you’d likely need to adjust the amount from year-to-year based on the actual and average past credits.

Income Monitoring to Preserve Tax Advantages

If you plan to use policy loans to provide income, keep in mind that the policy needs to stay in force until death in order to avoid a tax on gains that support the loan balance. If the policy lapses, the cash value is surrendered to pay off the loan balance. Be sure your company has a process to limit loans, use fixed loans, and manage insurance cost to keep the policy from lapsing.

Related: Two Main Issues with the Life Insurance Underwriting Process

Life Insurance Policy Review Case Studies

The prior graph shown for UL as ETI was run as an age 45 case with the minimum premium to carry the policy to age 80 based on current costs and a 7.10% IUL credit rate.

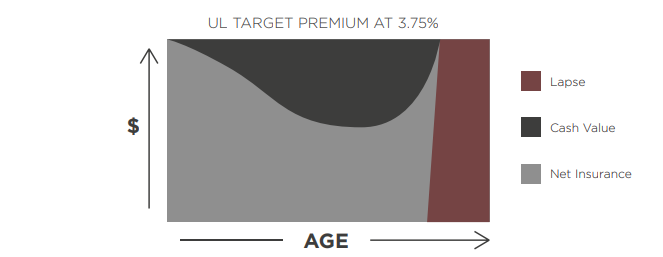

However, the credit rate doesn’t make a big difference because the cash value is so low. The following graph is the same case except it’s run with a fixed account of 3.75%, current costs, and a target premium that’s twice as much as the minimum premium. The policy is projected to carry to age 93 and the cash value in black peaks at age 80.

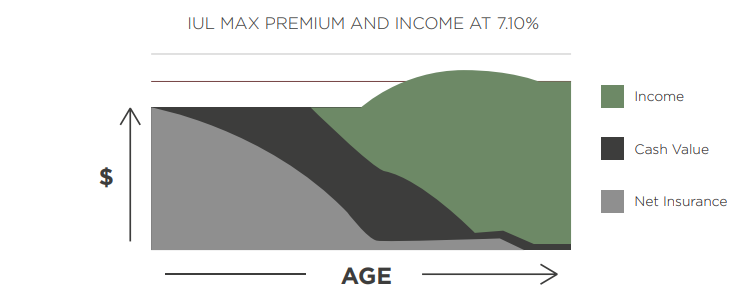

The next example is the same case with a maximum premium and with an indexed credit rate of 7.10%. With this higher credit rate and higher premium, the policy is projected to provide income equal to about three times the premiums paid.

While there are many combinations of how these values and benefits can be designed, the key concept is how the insurance amount in gray decreases to minimize costs and maximize values. The black again represents cash value and the green represents total income distributed.

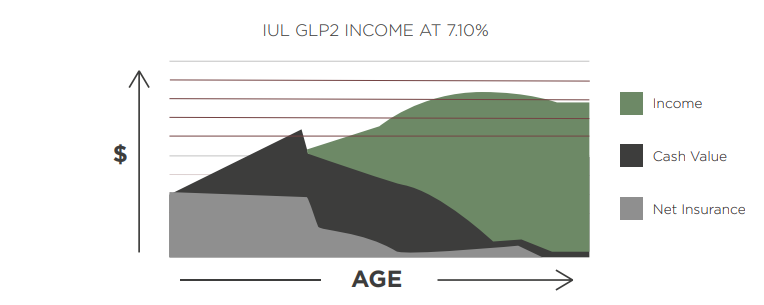

The next example is with the same maximum premium and the 7.10% index credit rate. The variation is to start with about 41% of the death benefit compared to the prior case, but have the death benefit increase to allow the same premium and then change to a level death benefit option when distributions begin.

The death benefit actually decreases with the distributions so you don’t see a level death benefit. The key concept again is how the insurance amount in gray decreases to minimize costs and maximize values. The black again represents cash value and the green represents total income distributed. This design provides about 21% higher income.

Level Term Insurance Followed by Decreasing Benefit

The following graph shows insurance tailoring of term life insurance coverage using a UL structure. The policy has a level death benefit (shown in gray) for a selected number of years such as 10, 15, or 20 years. The premium and benefit is guaranteed not to change during this time.

After the time period, the premium stays the same and the benefit is reduced. This pattern fits well with a transition into retirement using separate assets for retirement values and income.

Single-Premium Life Insurance and Reduced Paid-Up Insurance

A single-premium policy typically provides a level of guaranteed benefit with increasing cash value and the potential for additions based on non-guaranteed elements. It can be used to transfer values from an existing policy to a new single premium policy.

It’s similar to reduced paid-up (RPU) insurance options within a cash value policy that reduce the benefit and use the cash value to pay-up the policy so that no more premiums are needed or allowed. For example, a whole life policy can be converted to RPU and then experience increases due to non-guaranteed dividends.

Related: 7 Steps to Implementing the Comprehensive Analysis & Review Program [Infographic]

The content within this document is for informational and educational purposes only and does not constitute legal, tax or investment advice. Customers should consult a legal or tax professional regarding their own situation. This document is not an offer to purchase, sell, replace, or exchange any product. Insurance products and any related guarantees are backed by the claims-paying ability of an insurance company. Insurance policy applications are vetted through an underwriting process set forth by the issuing insurance company. Some applications may not be accepted based upon adverse underwriting results. The examples shown herein are hypothetical. Rates can and do change often. Rates may depend on your age, health, and gender. Your results will vary. Please be sure to ask your financial professional to run an illustration based on your specific information for any product that you are considering prior to purchase.