Updated April 10, 2024, at 12:02 PM

Have you heard the old saying, “You’ve never been younger and healthier than you are now?” It’s true!

When it comes to long-term care (LTC), the younger you are, typically the healthier you are. The cost of insurance is less for younger ages as well. And it’s why LTC for younger clients can make so much sense.

Don’t wait until your clients are older to bring up the care planning conversation. Because by having coverage early on, your clients may benefit due to any unforeseen events that take place in earlier years.

Layering Care Planning Coverage

Generally, financial professionals often think younger clients can’t afford LTC insurance or LTC insurance alternatives.

Check out this concept called layering: Your younger clients don’t necessarily need to purchase a policy covering 100% of the risk because it could leave them insurance-poor or spending over budget. Instead, start small to cover more of the risk in later years.

Related: 12 Long-Term Car Statistics That Can Spur Client Action [Infographic]

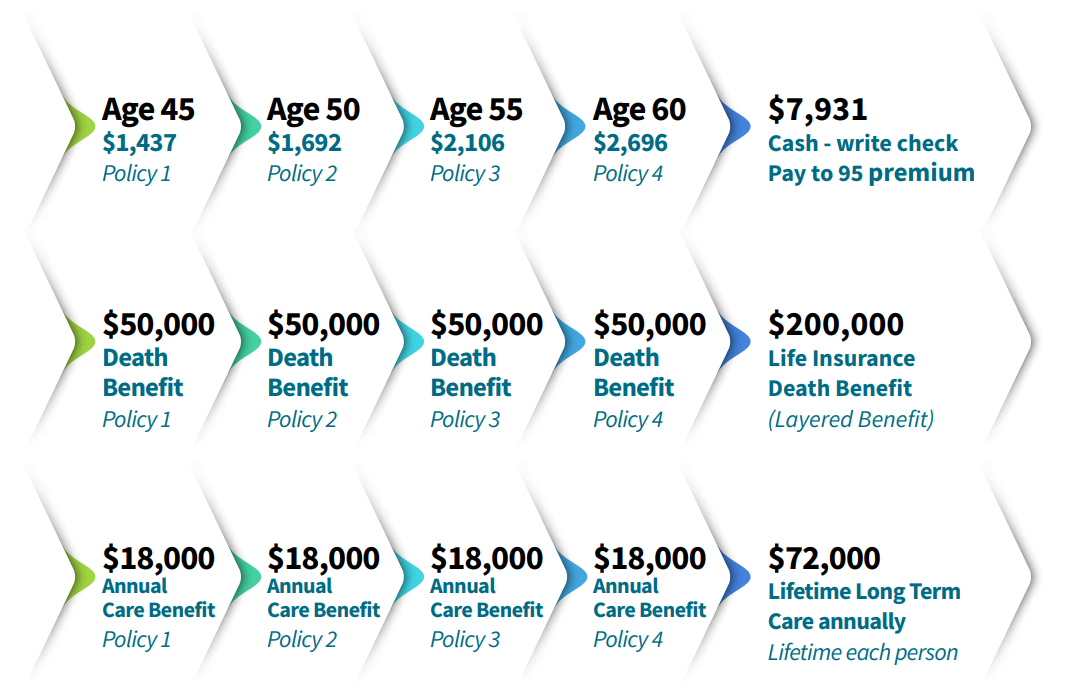

Take a 45-year-old couple, for example. Below you’ll see an example of a policy that they can start with by layering LTC. Then in their later years, they could continue adding on more policies. In the long run, it’ll save them money.

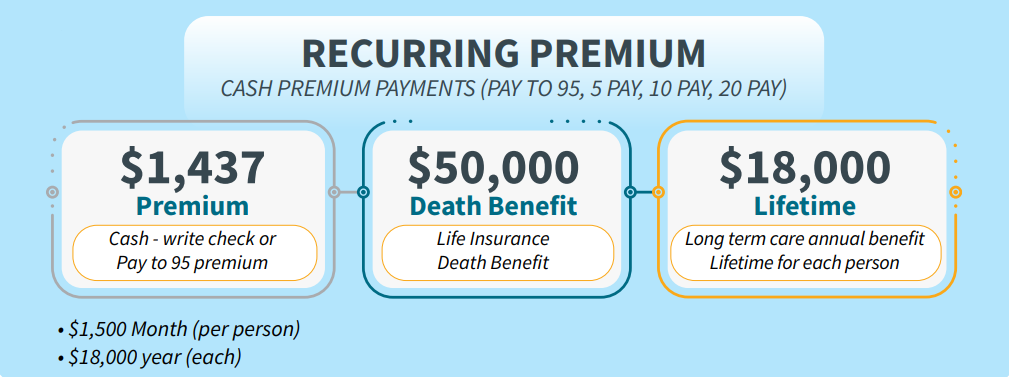

As you can see from the diagram, they buy a $1,500 per person, per month benefit, a lifetime benefit period, and a $50,000 death benefit if they don’t use it. The main idea is to purchase additional coverage every five years.

By age 60, they have a $6,000 monthly benefit per person, and a $200,000 death benefit for a total of $7,931. But here’s the kicker: had they waited until age 60, it would’ve cost them $10,384 instead. That comes out to an annual savings of $2,453. Plus, if something happens before age 60, such as an unforeseen health issue, they’ll have some level of protection at least.

Bottom Line on Layering LTC for Young People

Layering for LTC insurance is an excellent alternative to waiting until your clients are older when they’re usually more exposed to expensive health issues.

Please don’t wait until it’s too expensive.

Now is the time to talk about care planning. Reach out to your FIG Care Planning Division for more information on how you can implement care planning today.

Keep Reading: What to Know About Hybrid Long-Term Care Annuity Opportunities

Disclosure: The content within this article is for educational purposes only and does not constitute legal, tax, or investment advice. Customers should consult a legal or tax professional regarding their own situation. This article is not an offer to purchase, sell, replace, or exchange any product. Insurance company products (inclusive of Long-Term Care) and any related guarantees, features and/or benefits are backed by the claims-paying ability of the issuing insurance company. Long-Term Care applications are vetted through an underwriting process set forth by the issuing insurance company. Some applications may not be accepted based upon adverse underwriting results. Some of the information displayed within this article may be illustrative in nature, but may not be reflective of the outcomes you may experience. Your results will vary.